Author

[Hassan Al Barwani]

Published

[Dec 5, 2024]

Category

[Guides]

Real estate remains one of the most reliable ways to build long-term wealth — but success isn’t about luck; it’s about strategy. As the market continues to evolve with technology, shifting trends, and new investment models, understanding how to invest smartly in 2025 matters more than ever.

Why rental yield matters for property buyers

Rental yield shows how much income a property generates compared to its total cost. It is the simplest and most reliable way to measure investment performance before buying.

Helps you compare different properties

Two units may look similar, but their rental performance can differ significantly.

Rental yield allows you to compare them using clear numbers instead of assumptions.

Determines your annual income

A higher rental yield means more income every year relative to your investment amount.

This helps investors calculate returns and plan future purchases.

Reduces risk and improves decision-making

By analyzing yield, you avoid overpaying for properties with low demand or high service charges.

It ensures you only choose units that perform well in the long term.

“Smart investors never guess returns — they calculate them.”

How to calculate rental yield accurately

Rental yield is calculated using the total annual rent and the overall cost of the property. The table below summarizes the key formula.

Type | Formula | What It Measures |

|---|---|---|

Gross Rental Yield | (Annual Rent ÷ Property Price) × 100 | Measures income before expenses |

Net Rental Yield | (Annual Rent – Expenses) ÷ Total Cost × 100 | Measures true return after all costs |

Step-by-step rental yield calculation

Here’s a simple example to help buyers calculate yield effectively.

Find the annual rent (example: AED 80,000 per year)

Determine property price (example: AED 1,000,000)

Apply formula:

Gross Yield = (80,000 ÷ 1,000,000) × 100 = 8%Subtract expenses if calculating net yield

Compare properties using the same method

Understanding expenses that affect rental yield

Several ongoing costs can impact your net return. Knowing these helps you estimate your real earnings.

Service charges

These fees vary by community and building quality.

Higher amenities may increase costs but also attract better tenants.

Maintenance and repairs

Older or poorly maintained buildings may require more repairs.

Investors should consider long-term upkeep when calculating returns.

Management fees

If you use a property management company, fees typically range from 5%–8% of annual rent.

This cost should be included in net yield calculations.

Factors that increase rental yield

Choosing the right type of property and location can significantly boost returns.

Properties near business hubs

Units close to Downtown Dubai, DIFC, or Business Bay attract professionals.

These tenants pay higher rents for convenience.

Homes in family-focused areas

Communities with schools, parks, and supermarkets experience long-term demand.

Dubai Hills and MBR City often deliver stable yields.

Smaller units in high-demand zones

Studios and 1-bedroom units generally offer higher percentage yields.

They also have wider rental demand from young professionals.

Common mistakes investors should avoid

Being aware of these mistakes ensures stronger investment decisions.

Ignoring service charges

Focusing only on rent without considering annual expenses reduces real profit.

Always check service charges per sq.ft.

Choosing the wrong tenant segment

A property may yield poorly if it doesn’t match local tenant demand.

Research who typically rents in that community.

Underestimating vacancy risk

Some areas have stronger seasonal demand than others.

Check occupancy rates before investing.

Additional tools investors can use

Here are useful methods to deepen your rental analysis.

Compare yields across different communities

Use market reports and online platforms to benchmark yields.

This helps identify stronger-performing neighborhoods.

Check future infrastructure

Upcoming schools, metro lines, and malls can increase yield over time.

A rising community often outperforms established ones.

Evaluate off-plan vs ready yield

Off-plan units may offer higher future yields, while ready units begin earning immediately.

Choose based on your timeline and risk comfort.

Final recommendations for property investors

A few final points can help ensure your rental investment performs well.

Focus on realistic numbers

Avoid inflated projections and stick to verified market rents.

Realistic data leads to stable long-term outcomes.

Balance price with location

Affordable areas with strong connectivity usually deliver the best yields.

Examples include JVC, Arjan, and Dubai South.

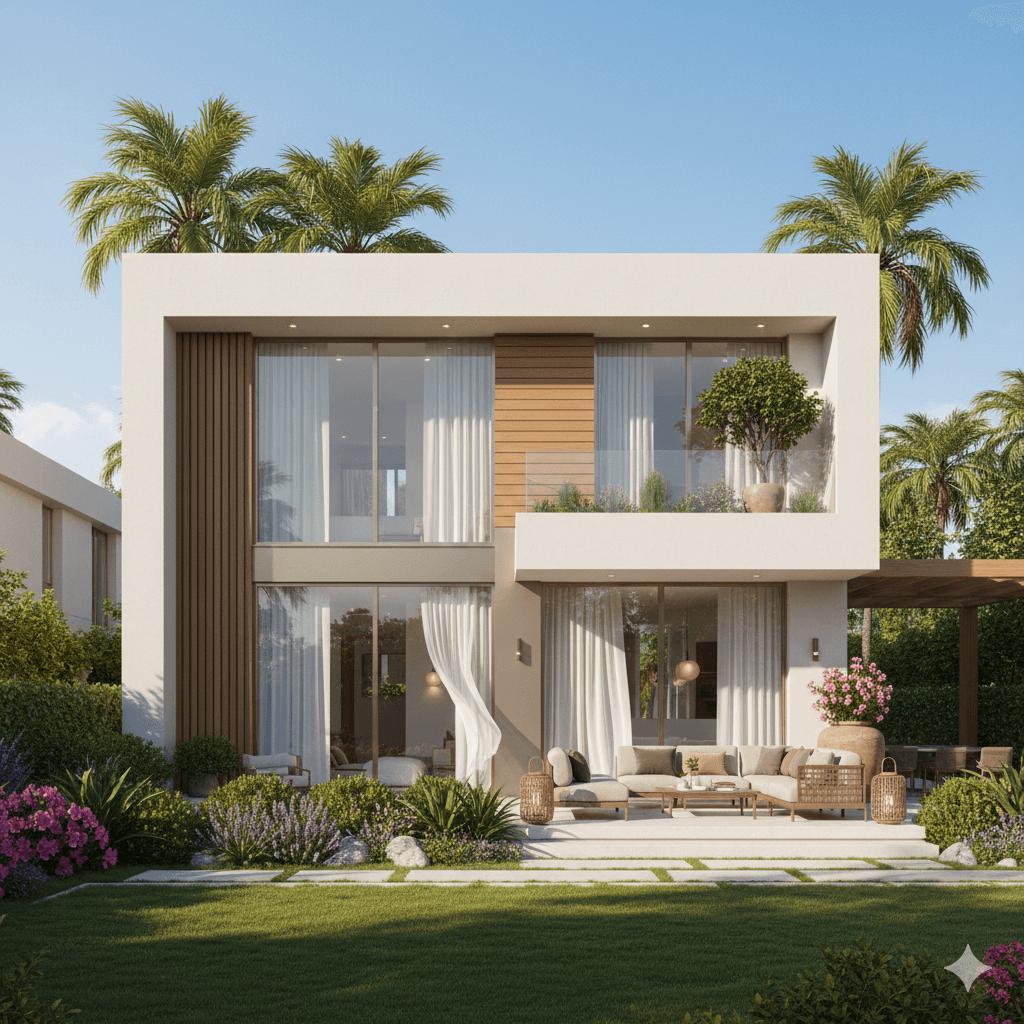

Choose properties tenants want

Homes with balconies, parking, good layouts, and modern design always rent faster.

Better tenant appeal increases occupancy and reduces vacancy losses.

What’s better than insider perks, pro tips, and surprises?

Sign up to get the most recent blog articles in your email every week.

Author

Hassan Al Barwani

Hassan Al Barwani is a seasoned property analyst and urban development enthusiast with extensive experience studying market trends, buyer behavior, and community growth across the UAE. His writing focuses on translating complex real estate insights into clear, practical guidance for investors, homeowners, and industry professionals. With a strong understanding of emerging development zones and long-term value drivers, Hassan helps readers stay informed, confident, and ahead of the market.